"Risk comes from not knowing what you're doing."

- Warren Buffet

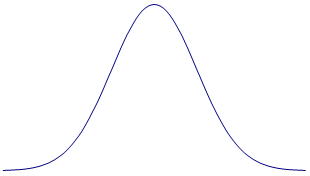

In his 1921 dissertation, University of Chicago economist Frank Knight made an important distinction between risk and uncertainty. He maintained that risk and uncertainty are different in one critically important respect: risk involves events whose odds of occurrence can be known with precision or, at minimum, are based upon some statistical evidence or scientific methodology producing estimable likelihoods. The probability distribution of the event in a risky situation can be known. Uncertainty on the other hand is associated with those events whose odds or probability distributions are not known or not reliably quantifiable.

In his 1921 dissertation, University of Chicago economist Frank Knight made an important distinction between risk and uncertainty. He maintained that risk and uncertainty are different in one critically important respect: risk involves events whose odds of occurrence can be known with precision or, at minimum, are based upon some statistical evidence or scientific methodology producing estimable likelihoods. The probability distribution of the event in a risky situation can be known. Uncertainty on the other hand is associated with those events whose odds or probability distributions are not known or not reliably quantifiable.

For example, there is risk inherent in the roll of a die. However, we know with certainty that the result will be an integer number with a minimum of 1 and a maximum of 6. If we bet on a 3 turning up prior to the roll, we have assumed some amount of risk. However, there is no uncertainty as to the possible outcomes or the odds of those outcomes; this event can be modeled quantitatively with absolute confidence.

Contrast this simple die roll with the infinitely more complex sets of possible outcomes that can occur on any day in the capital markets. Risk is certainly present, as in the roll of a die, but uncertainty also abounds. Events that are nearly if not entirely impossible to predict happen with some frequency, and as such, no amount of fancy number crunching (even from our applications!) is going to remove the danger inherent in financial exposure management. This lesson has been taught repeatedly throughout the history of finance, perhaps most notably with the portfolio insurance providers during the 1987 crash, the fall of Long Term Capital Management, and even today's, umm…challenging, credit market.

It may seem curious to find a cautionary warning about the limited power of quantitative finance tools in a blog post by a company that, in part, creates financial models. Nevertheless we cannot overemphasize the importance of humility in the face of capital market uncertainty. Market movements have been and will likely remain impossible to forecast with any meaningful degree of accuracy – that is, until we can with confidence statistically model the behavior of crowds and foresee the bouts of excessive optimism and fear that are characteristic of capitalist societies. Some practitioners within the burgeoning field of behavioral finance are attempting to do just that with encouraging results.

"Doubt is not a pleasant condition, but certainty is absurd."

- Voltaire

Since we know we need to consider both the knowable and unknowable range of future outcomes, are the risks alone worth quantifying? Do they only inject a false accuracy or worse, false security into the decision-making process? The unfortunate truth is that even in the face of looming and unknowable uncertainty (black swans?), we are compelled to make financial decisions. We unavoidably find ourselves in situations where we are forced to manage exposures as borrowers, as investors, or both. We don't have the luxury of "doing nothing." Doing nothing means we have either not removed or not assumed exposure to something; in both cases we are inevitably exposed to risk and uncertainty. Since we are forced to play our hand, I believe it is essential to have tools that at least give us a glimpse into the potential magnitude of the changes we might face.

Comments