As people soak in the joy (or tragedy depending on your perspective) of the latest apparent tax deal extending current marginal tax rates for a few more years, thought we'd check in and see what the money markets have to say about future tax rates. Many people may not know that swap markets provide a way to assess the almighty market's view of future marginal tax rates. Indeed they do and currently show a near zero value to future tax-exemption.

The vanilla SIFMA swap curve indicates what fixed rate a counterparty is willing to receive over a certain term in exchange for the SIFMA municipal swap index. It starts getting more interesting when you look at the SIFMA/LIBOR basis swap, which is the commitment to exchange SIFMA rates for 3M LIBOR on a quarterly basis for a specified term. You can calculate this by dividing vanilla fixed SIFMA swap rates by vanilla LIBOR swap rates. This currently ranges from about 90% at one year out to 88.5% at the thirty year point.

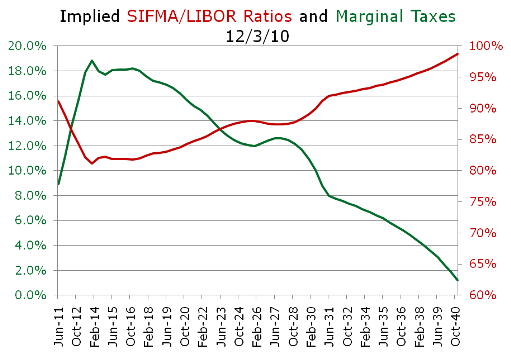

If we look at this ratio on a forward basis (3M forwards out thirty

years), we see that 3M forwards for SIFMA and LIBOR converge and almost sit on top of each other at the long end of the curve. See right vertical axis and red line in chart for forward SIFMA/LIBOR. But if SIFMA is effectively the tax-exempt equivalent of LIBOR, one minus this ratio provides us with the future implied marginal tax rate (left vertical axis green line). As you can see, implied forward tax rates steadily drop towards zero based upon current 3M SIFMA and LIBOR forward rates.

Why is this? Well there's an awful lot going on in the news these days that could be impacting this. Is the swap market pricing in the risk that the interest exemption on municipal bonds is repealed, thus eliminating the expected tax advantage for the SIFMA index? Or is it the likelihood that marginal tax rates simply decrease, along the lines of the deficit commission's recent report (pg 29)? Or is it that there's a lot of muni cash supply in the pipeline, BABs may not be renewed, investors are withdrawing cash from muni funds, the press is beating up state and local finances every other day comparing them to sub-prime, and this is just a mirrored reflection of the cash (bond) market showing up in the SIFMA swap market. Maybe it's a combination. Academics may debate the "pure expectations" rate hypothesis implicit in this whole discussion; though even critics should agree that given we're dealing with one forward rate divided by another, some bias should come out in the proverbial wash.

Of course it's impossible to say, but relative to assuming pure interest and liquidity risks in this environment which some are doing by renewing VRDB facilities, it's an interesting relationship to consider. What do you think?

Comments