"Prediction is very difficult, especially if it's about the future." - Niels Bohr

The other day one of our clients, Melio & Co, helped Trinity Health determine final deal structure on their $1 billion+ issue using Refunding Adjusted Yield (RAY). There were a variety of different coupon and optional redemption structures in play and Trinity needed to know where the market was offering attractive value. Melio & Co used RAY's real-world modeling to deliver exactly that insight to Trinity. And RAY does this by faithfully modeling the sometimes messy economics of refunding.

To test what the market offered, Trinity decided to use a 7% net present value savings criterion in the RAY calculation. As Mark Melio said, “One of the attractive features of RAY is its ability to incorporate an issuer’s actual refunding criteria.”

A powerful feature of the market model embedded in the RAY calculation is its ability to create both non-call and callable yield curves. This is in contrast to no-arbitrage yield curve and bond option models that not only fail to capture realistic changes in yield curve shape, but almost invariably force the use of non-call curves - notoriously difficult to estimate in the municipal market.

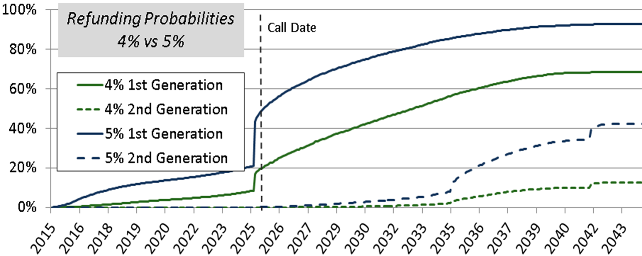

With callable borrower yield curves in hand, RAY quantified not only first generation refunding savings but also the refunding of the refunding bonds i.e. the 2nd generation refunding. Of course, expected tax law is respected; advance refunding of callable advance refunding bonds can only be done taxably, or precluded altogether as selected by the modeler.

The table below shows some key results of the RAY analysis for 2 callable bonds. They allow us to draw some interesting conclusions.1 The yield to maturity on the 5s is higher than the 4s as our intuition would tell us. But when looking at RAY1 (the “1” indicating only 1st generation refundings), the 4s looked about 5bps more attractive to Trinity than the 5s, 3.752% vs 3.802%.

|

|

Yield to Maturity |

RAY1 |

RAY |

|

4% Coupon Bond, 10Y call |

3.881% |

3.752% |

3.719% |

|

5% Coupon Bond, 10Y call |

4.073% |

3.802% |

3.673% |

However we also know that relative to the 4s, the 5s are likely to be refunded earlier and more often. Given our modeled refunding bonds were themselves callable after 10 years, this means the 5s are likely to be refunded with callable bonds more frequently, which in turn will lead to greater 2nd generation savings. And the full RAY calculation, capturing both 1st and 2nd generation refundings, quantifies this greater benefit directly.

Adding the 2nd generation refundings reduces RAY on the 4s by about 3bps while the 5s fall by about 13bps. This changes the answer entirely and actually leaves the 5s looking about 4bps cheaper and ultimately more attractive to Trinity than the 4s.

How would RAY change with a 5.50 coupon? Or an 8 year call? What about different refunding criteria? Excellent questions all. Stay tuned or better, we'd love to hear from you.

info@intuitive-analytics.com, 646.202.9446x101

1Results have been modified slightly to preserve confidentiality.

Comments