SmartModels Utilities: Simulate

Interest rate uncertainty is at peak levels. SmartModels Utilities give you a fast, powerful way to analyze interest rate variability with the Simulate Rates function. Using our industry standard, mean-reverting interest rate model, SmartModels Utilities allow you to quickly get entire distributions of interest rates with just a few quick inputs.

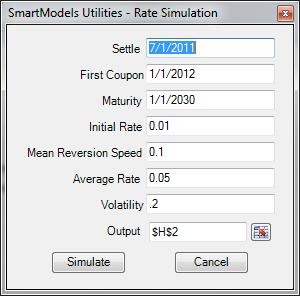

Steps to using SmartModels Utilities' Simulate Rates function are:

- Select Simulate Rates from the dropdown

- Enter relevant dates: Start Date, First Rate Date, and End Date

- Enter rate model parameters: Initial Rate, Mean Reversion Speed, Average Rate, and Volatility

- Select the output range

- Click the Simulate button

BENEFITS

- Speed – Create a complete interest rate simulation to understand interest rate variability in seconds

- Simplicity – Though many consider interest rate modeling the domain of “rocket scientists” only, this function gives anyone the most powerful features of a rate model

- Flexibility – tweak the input for mean reversion and you have an equity return simulation model

- Speed again - Input ranges are set and stored in the interface until the user changes it, saving additional time when data changes and recalculation is necessary