SmartModels Utilities: Structure Bonds

Getting a quick tax-exempt debt structure in a spreadsheet is doable though it’s easy to make mistakes and slow if you’re starting from scratch. With a simple 3 column input range of maturity dates, par bond yields, and revenue, the SmartModels Utilities’ Structure Bonds function gets you to a basic bond structure in no time in $5,000 denominations.

Interpolate in SmartModels Utilities makes this a snap:

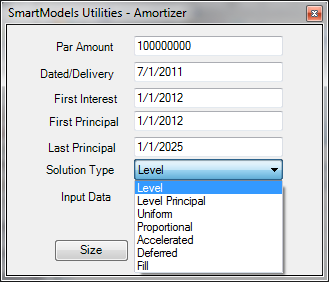

- Go to SmartModels Utilities and select Structure Bonds from the dropdown

- Enter a par amount, dated/delivery dates, first interest and first and last principal dates

- Select from one of the six Solution Types to create the desired amortization shape

- Select the 3 column input range of date, par bond yields, and revenue

- Click the Size button

Output is a three column range of date, principal amount, and interestBENEFITS

- Speed – In seconds get a clean bond solution without messing around with any spreadsheet formulas. Enter and highlight the inputs and you’re done

- Accuracy – Avoid simple but ubiquitous spreadsheet mistakes by using tested Intuitive Analytics algorithms

- Speed again - Input ranges are set and stored in the interface until the user changes it, saving additional time when data changes and recalculation is necessary