"...the traditional ways of seeking competitive advantage are redundant and...the future lies with the ability to analyse the very considerable volumes of data it amasses about itself." --The Financial Times, April 18, 2007

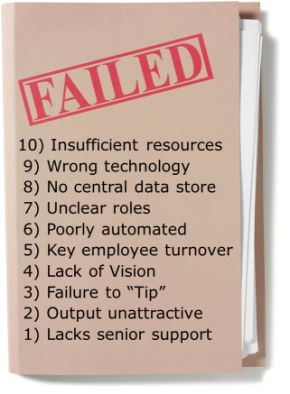

One of our 2 main lines of work involves the automation of public finance data management i.e. issuer debt profiling; it’s a big part of what we do for a living. But we wouldn’t live very well if we weren’t deeply in tune with the reasons why technology initiatives to address this inherently messy problem fail. Here’s our top ten:

#10. Insufficient resources

Each public finance investment banker chases a dozen issuers or more which ultimately means 500 to 5,000 relevant CUSIPs per banker. That’s 50,000 to 150,000 CUSIPs from the 70,000+ tax-exempt issuers out there for a medium to large size public finance practice. For each CUSIP you need to track refundings, ratings changes, redemptions, tenders, primary market sales performance and ideally even secondary market trading activity. This is a big data management problem that’s usually addressed in an ad hoc way by pools of analysts and associates; it can easily take up to 30 to 60% of their time.

That said, many initiatives to automate this work consist of 1 or 2 people’s part time job (some business people call this a "hobby"). Automating the management of public finance data is a big, difficult problem that hobbyists won't solve. If you don’t plan to spend some resources on making it happen so it really works, don’t try it.

# 9. Wrong technology

As we’ve detailed before here, selecting the right technology for a given problem is no easy task. Spreadsheets are ubiquitous in finance but they’re no replacement for what you can do with a real programming language…of course that requires programmers and not spreadsheet jockeys. If everything’s done via intranet (preferred by most in IT), it requires expensive interface design. The technology choices are not simple and can’t be taken lightly or the solution just won’t satisfy the objectives of the business.

#8. No central data store

As we've detailed in another top ten post here, if after you’ve implemented your data management solution, your clients’ essential bond and swap data is scattered across dozens or hundreds of spreadsheets sprinkled among various offices, your solution won't cut it. Having a central data warehouse provides for critical analytic and automation features that don’t happen any other way. Plus it protects your valuable business data from being misappropriated every time an employee heads off to a bigger, better guarantee package.

#7. Unclear roles / limited accountability

If no person has been assigned clear responsibility and accountability for the quality, breadth, and timeliness of your public finance data, your solution will be plagued with inaccurate and stale info which will ultimately undercut its value and legitimacy. Clearly communicated roles are a pre-requisite to success.

#6. Poorly automated

Sure, your Bloomberg spreadsheet pulls in a bunch of info from originally issued CUSIPs, but how much work do you do to get attractive reports and charts detailing accurate current outstandings, series summary information, refunding genealogies, and color mapped debt profiles? If the answer’s “a lot” people are happy to do things the old, manual, flexible, slow, inaccurate way.

#5. Key employee turnover

So you’ve got someone who fancies herself a technology wizard and she’s put together a nice Bloomberg-linked spreadsheet with which people can grab issuer data. She’s even had a rollout session to train analysts. Eventually she gets a promotion and has moved on to frontline IB work managing clients. After a year she finds greener pastures and moves on to another firm (and brings her handy spreadsheet with her). Over time, new analysts come in the door and eventuallly it’s the data Wild West again and that spreadsheet is the stuff of institutional lore.

Many initiatives simply flounder once a key player leaves and a leadership void remains unfilled (see #1 below).

#4. Lack of vision

There’s a zipper line between bankers and the IT folks. Investment bankers generally don’t talk tech and IT doesn’t speak much public finance. At this critical seam (sometimes chasm) lies the ability to dream of what would be possible with the right data, the right technology, designed the right way, for the most relevant use cases to get maximum value. Without vision, the solution will never materialize into the truly essential, integrated tool that it should be, and will fail to get past the tipping point…

#3. Failure to "tip"

Without sensitivity to how the solution will change analyst and banker workflow and longstanding habits, institutional and individual inertia will threaten the best designed solutions. Absent organized training, senior level involvement, and sufficient banker/analyst support, a solution won’t tip and as such will be relegated to the many stories of failed business initiatives that “a few guys worked on a couple years back.”

#2. Output unattractive or inflexible

We know bankers, and if any of them doesn’t have a strong opinion about how their client’s debt should be laid out, they’ll pretend they do just to fit in. If your automatic output reports are unattractive or can’t be customized, people will be left just doing everything from scratch in Excel (see #6 and poor automation)

#1. Lacks senior support

And the #1 reason why these initiatives fail is lack of visibility and importance at the highest level of the business, and this happens a lot as more fully described in Competing on Analytics.

More specifically in public finance, as an analyst gains experience through a career and moves through the ranks of associate, VP, and perhaps MD, there’s one continuous objective – unload the undesirable, uninteresting, unimportant tasks to whomever’s less senior and within shouting distance. Unfortunately the important work of getting an issuer’s capital structure together properly is the public finance equivalent of ditch digging. As such, those analysts who ultimately become heads of public finance departments have been pushing off the problem of public finance data management to other people their entire careers.

RESULT: despite the fact that a public finance business spends millions of dollars of person-hours every year on the management of its data, senior leadership doesn’t see it as a problem that can be addressed with a thoughtfully- designed, department-wide solution.

Get more information on why we believe otherwise.

Comments