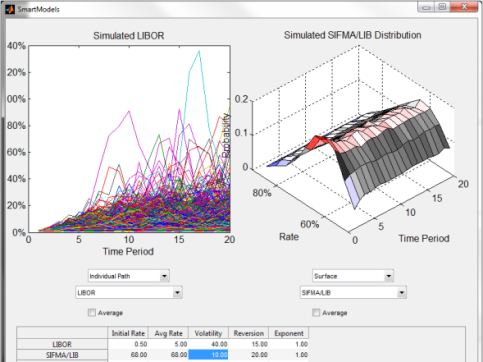

Using SmartModels Stage III, this video is a case study in analyzing whether to issue fixed or variable rate debt, both with and without cash on the balance sheet serving as a natural hedge. We calculate Cash Flow at Risk (CFaR) for the VRDBs and then graph the tradeoff between average annual (expected) debt service and CFaR. In the "with balance sheet cash" case, an efficient frontier-esque chart results from showing an optimal amount of VRDBs to issue.