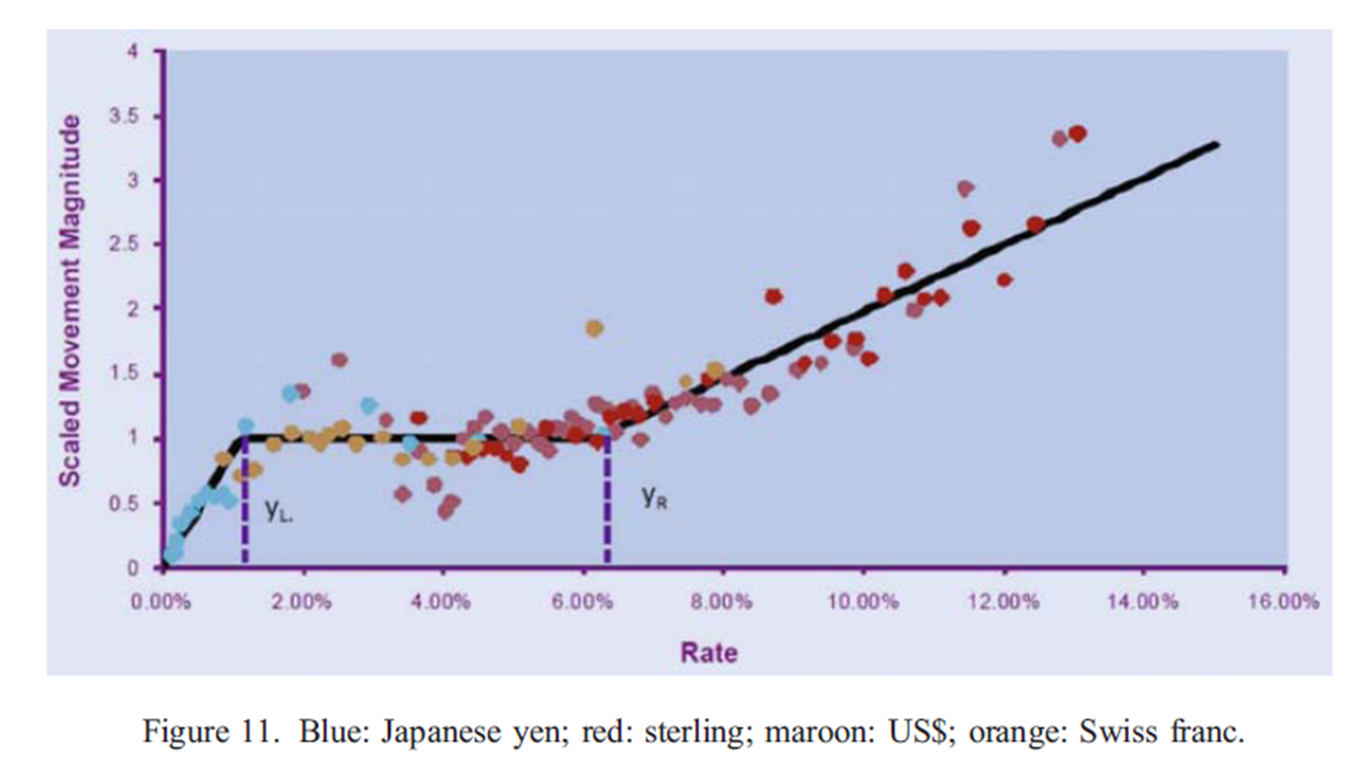

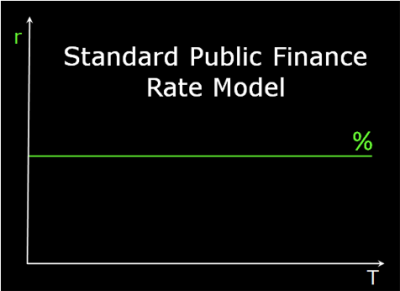

Last summer I wrote an article describing a missing link in rate modeling that had been discovered in exciting new research by Nick Deguillaume, Ricardo Rebonato, and Andry Pogudin entitled The nature of the dependence of the magnitude of rate moves on rates levels: a universal relationship. This mouthful offered two simple takeaways. First, accurately capturing how rates are expected to change, particularly over long time horizons, is central to every rate risk management decision we face. And second, that so-called “standard models” that don’t provide for the observed fact that rates tend to change differently depending on their level aren’t so realistic nor as a result, very good at informing interest rate decisions like refunding opportunities.